Investment Policy:

Lao PDR’s investment policy has been formulated with a view to invite and encourage domestic and foreign investment in Lao PDR. In 2009, the law on investment promotion was formulated with primary focus on allowing domestic and foreign investors to conveniently and quickly conduct their business operation in Lao PDR.

The government promotes the investment in all sectors and all areas throughout the country except areas and business operations which are detrimental national security, the natural environment, public health and the national culture.

Advantages to invest in Laos:

- Political and economic stability

- A lot of abundant water resources and natural resources including mineral, sources of energy, forests, which could be developed through proper technology and converted to commodities for export into the international markets.

- Low cost competitive workforce

- Laos is situated in an economic growth area, sharing borders and common interests with Thailand, Vietnam, Cambodia and China

- Lao PDR is a land-link country which has access to ASEAN market with the population of 500 million including southern part of China

- The Lao government established special economic zones

- The enactment of laws on investment promotion, business, labor and etc

- Lao is Eligible for Generalized System of Preferences (GSP) from 42 countries and Normal Trade Relation (NTR) with the USA because it considered as a least developed country. In addition, countries like European Community and Japan have granted Laos trading privileges such as tax exemption on imports where more than 200 listed items are under a special quota. Therefore, Lao products can access the global markets with lower tariffs or completely duty free

- Prices now rely on market value and enable the private sector to determine water rates and set prices itself.

- Laos provides investors with various tax incentives including tax exemption, tax holiday, no import tax for raw materials to be processed and re-export and no tax for export.

Forms of Investment

- Joint Venture between foreign and domestic investors

A joint venture between domestic and foreign investors is a joint investment between domestic and foreign investors who conduct business operations, have shared their property owned and have established a new legal entity under the law of Lao PDR

- Businesses Investment by contract

A business investment by contract is a business arrangement between domestic and foreign legal entities defined in the agreement without establishing a new legal entity or branch office in the Lao PDR

- A wholly domestic and foreign owned investment

A wholly domestic and foreign owned investment is a wholly investment by a domestic or a foreign investor that can be only one or more in the enterprise or project in Lao PDR

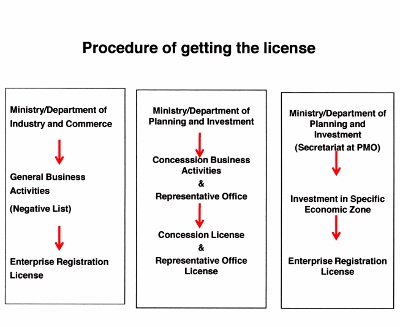

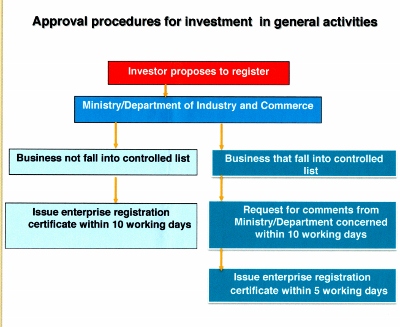

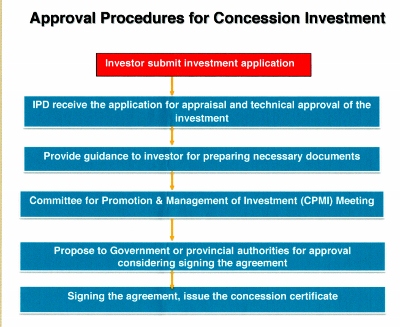

Investment Procedures

Step 1:

Apply for/obtain anInvestment license and Enterprise Registration Certificate from the One Stop Service Unit, Investment Promotion Department, Ministry of Planning and Investment.

The following documents shall be provided by investors:

- Investment Application Form (provided by One Stop Service Unit);

- Articles of Association/Bylaws of the companies to be established;

- Feasibility study/Business plan;

- Joint Venture Agreement (for a Joint Company to be established);

- Appendices to Application Form

- Investor’s Curriculum Vitae, Passport Copy (for foreigner) and for Lao investor, copy of ID and family book, 6 copies of 3X4 photo

- Bank Statement/Financial Statement certifying investment solvency)

- Letter of Authorization/Power of Attorney if necessary

Step 2:

Apply for/Obtain a Tax Registration Certificate

The following documents are required:

- Application letter to the Tax Department, requesting Tax registration;

- Beginning balance sheet;

- Copy of Investment License;

- Copy of Enterprise Registration Certificate

- Bank statement from a local bank for cash-only registered capital

- List of personnel staff employed by the company

Step 3:

Apply for/Obtain a Company seal

The following documents are required:

- Copy of Investment License

- Copy of Enterprise Registration Certificate

- Copy of Tax Registration Certificate (issued by Tax Department)

One Stop Service Unit

The One Stop Service Unit, Ministry of Planning and Investment will provide investors assistance in regard to investment procedures and guide the applicant through the process of completing them, including a feasibility review upon re-submission.