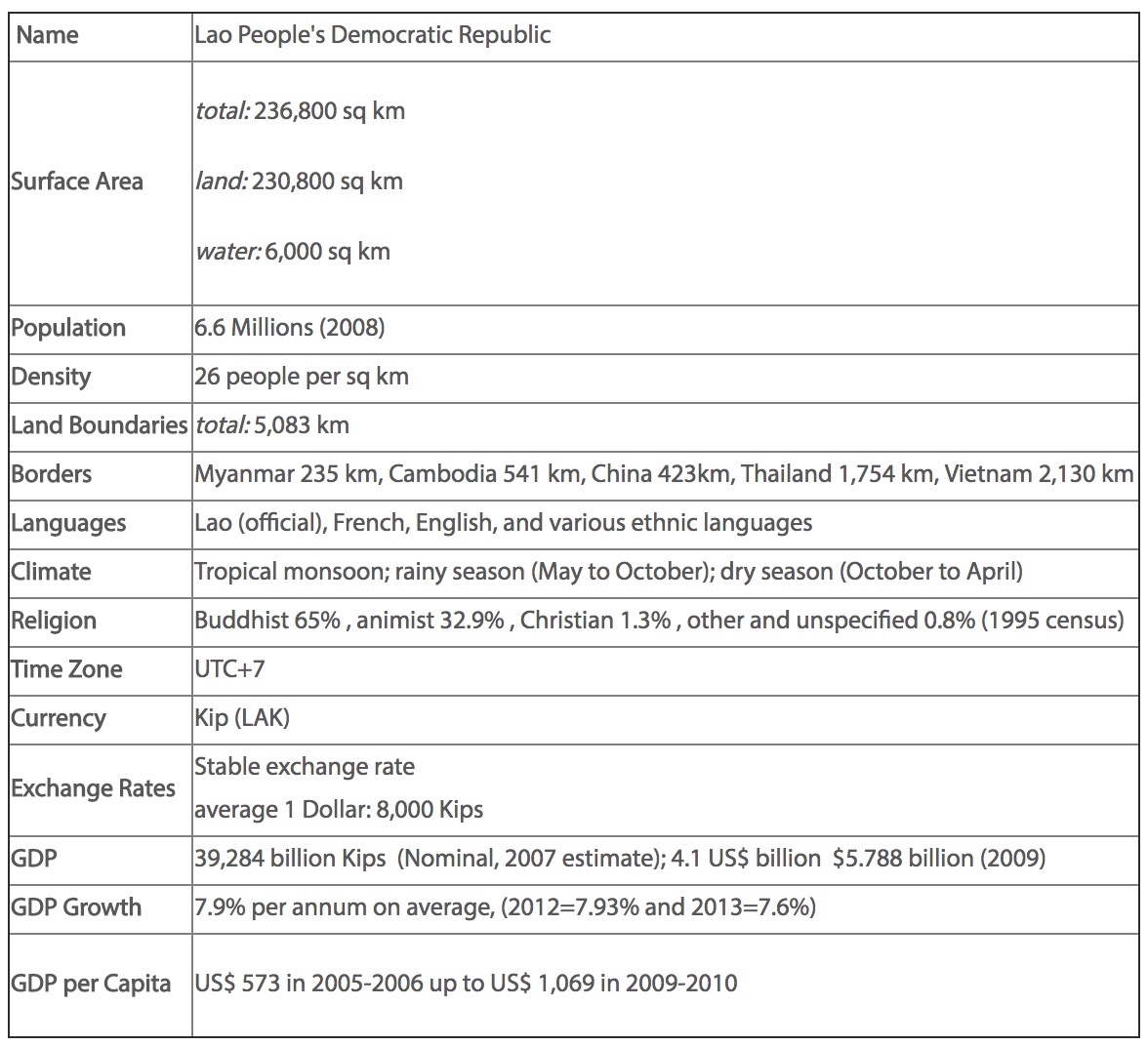

General Information: Lao PDR at a Glance

Source: MPI (2014)

General Information: Laos = The Land-Linkage Nation and Potential of Economic Zones

The Lao government vision is to establish Laos from the Land-Locked Country to the Land-Linked Nation. At the Moment, there are several routes to connect ASEAN to China such as Road No. 3 (R3) connecting Thailand-Laos-China (called North-South Corridor), in the central there is East-West Corridor, which is Road No. 9 connecting Thailand-Laos-Vietnam. In addition, the government of Laos also established the potential of economic zones such as Savan-Seno Economic Special Zone (Savannakhet Province).

General Information: Investment Climate and Advantages in Investment in Laos

In terms of investment in Lao PDR, the investment destination in Lao PDR is known as: LAOS: Land of Ample of Opportunities & Success.This slogan is tell the true about doing business in Lao PDR. We have a lot of advantages in offering investors both domestics and foreign. By doing business in Laos, the investors can enjoy a lot of opportunities as stated below.

- Advantages of Investing in Lao PDR

Integrated to the regional and international arena:

- Member of international organizations

- General Special Preferences (GSP) Privileges with 42 countries

- Normal Trade Relations (NTR) with USA (04/02/2005)

- Bilateral Investment Treaties with 27 countries

- In process of joining World Trade Organization (WTO)

Comparative Advantages:

- Plentiful Natural Resources with unexploited

- Large Area of Fertile Agricultural Land

- Varieties of Tourism Development Sites

- Virtually no damaging natural disaster

Competitive Advantages:

- One of the most Politically Stable Country in the Region

- Socio-Economic and Financial Stability

- High Security (Low Crime Rate)

- Low Labor Costs compared to neighboring countries

- GSP Privileges given from 42 countries

- Liberal Laws and Regulations creating favorable business and investment environments

Note:

At the moment, the government of Lao PDR is negotiating for the WTO accession. By participating in the WTO rules, we can ensure foreign investors for our commitment in the international arena.

Tax and Duty Incentives

Investment Promotion Zoning in Lao PDR

I. General Customs and Tax System and Fiscal Incentives

- Regular Custom and Tax Systems in the Lao PDR:

- Regular Import duty rates are between 3% – 40%

- Indirect taxes include: (1) Business turnover tax between 5% – 10%; (2) Excise tax between 5% – 90%

- Direct taxes include:

- Corporate Profit tax:

– Existing law on tax: Foreign (20%) and Domestic (35%).

– As of November 2011, the law on tax is in course of revising to unity the general profit tax for foreign and domestic investors. The new tax rate is speculated in the range of 24% – 28%.

- Minimum tax at the rate of 0.1% of total revenue.

- Personal income tax between 0% – 25% (progressive rate) after revising the law on tax.

- Fees and service charges.

- Investment Promotion Incentives:

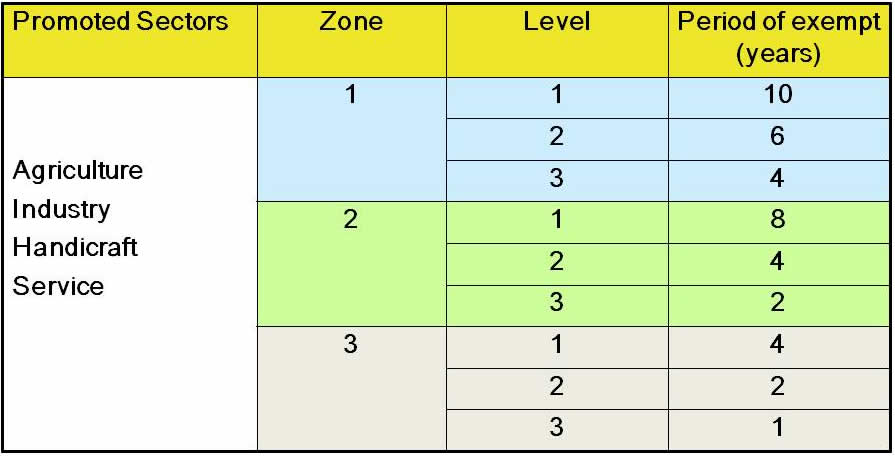

According to Article 49 of the Investment Promotion Law (IP Law), the promoted sectors are agriculture, industry, handicraft and services. Details of promoted activities under the sectors are determined by the Government and classified into three different levels based on prioritized activities of the Government, the activities related to the poverty reduction, the improvement of living conditions of people, construction of infrastructure, human resource development, jobs creation, etc. The Government has established the following fiscal incentive systems:

1. Incentive or Corporate Profit Tax (Based article 50 and 51 of the IP Law)

Note: Refer to Investment Promotion Zoning Ma

- Zone 1: Mountainous, Plateau zones with no economic infrastructure to facilitate investments;

- Zone 2: Mountainous, Plateau zones with a moderate level of economic infrastructure to accommodate investments;

- Zone 3: Plateau zones with good economic infrastructure available for investments;

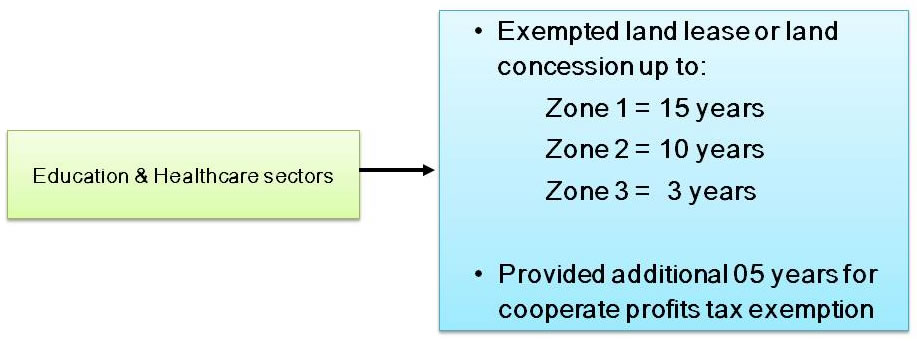

2. Specific Promotion Incentives (According to Article 54 of IP Law)

Investments in the construction of hospitals, kindergartens, schools, vocational schools, colleges, universities, research

centers and some public utilities shall obtain the exemption rental or land concession as follows:

3. Other Promotion Incentives (According to Article 52 of IP Law)

In addition to the profit tax incentives, investors shall be also entitled to customs duty and tax incentives, as follows:

1. Exemption from profit tax in the next accounting year, if the net profit derived from business activities is used for business expansion.

2. Exemption from import duties for the importation of raw material, equipment, spare parts and vehicles which are directly used for production. However, exemption of import tax shall comply with specific regulations.

3. Exemption from export duties for exportation of general goods and products. The exportation of natural resources and natural resources-made products shall comply with concerned regulations and laws. The importation of all types of fuel is not exempted from duties and taxes.

4. If an investor suffers losses after completion of tax finalization with the tax office, the investor shall be permitted to carry the losses forward to three consecutive accounting years. After ending of the period, any remaining losses shall not be allow to be deducted from profit. For special economic zones and specific economic zones, the provision of incentive treatment shall be in compliance with the Decree on the Establishment and Activities of respective zone.

II. Regular Customs and Tax Systems in the Lao PDR

1. Regular Import duty rates are between [3% – 40%]

2. Indirect taxes include

– Business turnover tax between [5%– 10%]

– Excise tax between [5% – 90%]

3. Direct taxes include

+ Corporate Profit Tax:

– Existing law on tax: Foreign (20%) and Domestic (35%)

– As of November 2011, the law on tax is in the course of revising to unify the general profit tax for foreign and domestic investors. The new tax rate is speculated in the range of 24%-28%

+ Minimum tax at the rate of 0.1% of total revenue

+ Personal income tax between 0%-25% (progressive rate) after revising the law on tax.

+ Fees and service charges

III. Regulation on Importation

Under the new investment law, the master plan of the importation has to be submitted at the Custom Department, Ministry of Finance directly.

-

- Investors must submit their annual importation plans in accordance with the Custom Department standard forms at the Department of Custom (DOC), Ministry of Finance. DOC will consider approving and issuing a certificate within 20 business days from the date of receiving the request*.

- The approved annual importation plans will be transmitted to officials at the border where the importation will take place to monitor and deduct the balance based on actual importation.

- Approved annual importation plans can be modified once.

- Additional importation not included in the annual importation plans such as utilities or emergency spare parts to replace the old and broken ones shall be consulted or submitted to the Ministry of Finance (Custom Department) directly.

Approval Producer for the annual importation plan

Note:

* Timing for approval depends on the investment activities and the type of goods to be imported. But normally, it will take 20 working days for such approval. For greater detail on this, please consult with the Custom Department, Ministry of Finance.

Non-Tax Incentives

The government provides the following incentives to all foreign investors:

Permission to bring in foreign nationals to undertake investment feasibility studies.

Permission to bring in foreign technicians, experts, and managers if qualified Lao nationals are not available to work on investment projects.

Permission to lease land for up to 20 years from a Lao national and up to 50 years from the government.

Permission to own all improvements and structures on the leased land, transfer leases to other entities, and permission to sell or remove improvements or structures.

Facilitation of entry and exit visa facilities and work permits for expatriate personnel.

The government also offers guarantees against nationalization, expropriation, or requisition without compensation. Under the IP Law, the government does not offer incentives of import protection (in the form of increasing duties or banning imports) for import-substituting investments and it does not provide measures to restrict further entry to reduce competition for current investors. The policy of not reducing market competition as an incentive for investors is not a feature of the foreign investment systems of most other countries, such as Thailand and Vietnam, in the region.

SOURCE: http://www.investlaos.gov.la